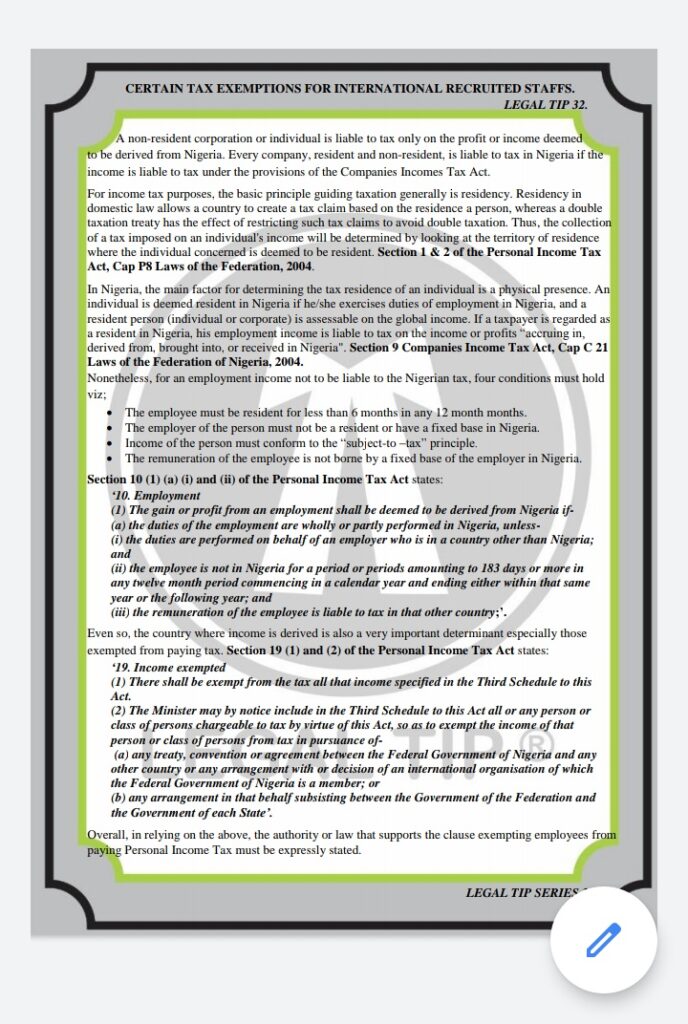

A non-resident corporation or individual is liable to tax only on the profit or income deemed to be derived from Nigeria. Every company, resident and non-resident, is liable to tax in Nigeria if the income is liable to tax under the provisions of the Companies Incomes Tax Act.

For income tax purposes, the basic principle guiding taxation generally is residency. Residency in domestic law allows a country to create a tax claim based on the residence a person, whereas a double taxation treaty has the effect of restricting such tax claims to avoid double taxation. Thus, the collection of a tax imposed on an individual’s income will be determined by looking at the territory of residence where the individual concerned is deemed to be resident. Section 1 & 2 of the Personal Income Tax Act, Cap P8 Laws of the Federation, 2004.

In Nigeria, the main factor for determining the tax residence of an individual is a physical presence. An individual is deemed resident in Nigeria if he/she exercises duties of employment in Nigeria, and a resident person (individual or corporate) is assessable on the global income. If a taxpayer is regarded as a resident in Nigeria, his employment income is liable to tax on the income or profits “accruing in, derived from, brought into, or received in Nigeria”. Section 9 Companies Income Tax Act, Cap C 21 Laws of the Federation of Nigeria, 2004.

Nonetheless, for an employment income not to be liable to the Nigerian tax, four conditions must hold viz;

• The employee must be resident for less than 6 months in any 12 month months.

• The employer of the person must not be a resident or have a fixed base in Nigeria.

• Income of the person must conform to the “subject-to –tax” principle.

• The remuneration of the employee is not borne by a fixed base of the employer in Nigeria.

Section 10 (1) (a) (i) and (ii) of the Personal Income Tax Act states:

‘10. Employment

(1) The gain or profit from an employment shall be deemed to be derived from Nigeria if-

(a) the duties of the employment are wholly or partly performed in Nigeria, unless-

(i) the duties are performed on behalf of an employer who is in a country other than Nigeria; and

(ii) the employee is not in Nigeria for a period or periods amounting to 183 days or more in any twelve month period commencing in a calendar year and ending either within that same year or the following year; and

(iii) the remuneration of the employee is liable to tax in that other country;

Even so, the country where income is derived is also a very important determinant especially those exempted from paying tax. Section 19 (1) and (2) of the Personal Income Tax Act states:

‘19. Income exempted

(1) There shall be exempt from the tax all that income specified in the Third Schedule to this Act.

(2) The Minister may by notice include in the Third Schedule to this Act all or any person or class of persons chargeable to tax by virtue of this Act, so as to exempt the income of that person or class of persons from tax in pursuance of-

(a) any treaty, convention or agreement between the Federal Government of Nigeria and any other country or any arrangement with or decision of an international organisation of which the Federal Government of Nigeria is a member; or

(b) any arrangement in that behalf subsisting between the Government of the Federation and the Government of each State’.

Overall, in relying on the above, the authority or law that supports the clause exempting employees from paying Personal Income Tax must be expressly stated.

Superb, what a web site it is! This webpage provides useful data to us, keep it up.

Hello to all, because I am in fact keen of reading this

blog’s post to be updated on a regular basis. It

includes nice material.

Quality articles or reviews is the main to invite the people to go to see the web

page, that’s what this web site is providing.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each

time a comment is added I get three e-mails with the same

comment. Is there any way you can remove me from that service?

Appreciate it!

Thanks for a marvelous posting! I really

enjoyed reading it, you are a great author.

I will make certain to bookmark your blog and definitely will come back later on. I want

to encourage you to ultimately continue your great job, have a nice morning!

Hey there just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Chrome.

I’m not sure if this is a formatting issue or something to do with browser compatibility but I

thought I’d post to let you know. The style and design look great though!

Hope you get the issue fixed soon. Kudos

I’m really impressed with your writing skills as well

as with the layout on your blog. Is this a paid theme or did

you modify it yourself? Anyway keep up the nice quality writing,

it is rare to see a great blog like this one today.

Good post. I learn something totally new and challenging on blogs I stumbleupon on a

daily basis. It’s always useful to read content from other authors and use something from their websites.

Greate article. Keep posting such kind of information on your

blog. Im really impressed by your blog.

Hey there, You’ve done a great job. I will definitely digg it and for my

part recommend to my friends. I am sure they will be benefited

from this site.

Heya! I just wanted to ask if you ever have any problems

with hackers? My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no backup.

Do you have any solutions to prevent hackers?

Your style is really unique in comparison to other people I have read stuff from.

Thanks for posting when you’ve got the opportunity, Guess I’ll just bookmark this page.

Because the admin of this website is working, no doubt very soon it will be famous, due to its quality contents.

I just like the helpful information you supply to your articles.

I will bookmark your blog and take a look at again right here frequently.

I am relatively sure I will learn a lot of new

stuff proper here! Good luck for the next!

Hey there! Quick question that’s completely off topic.

Do you know how to make your site mobile friendly?

My site looks weird when browsing from my iphone 4. I’m trying

to find a template or plugin that might be able to resolve this problem.

If you have any recommendations, please share. With thanks!

Remarkable! Its genuinely remarkable article, I have got much clear idea on the topic of from this paragraph.

Hello are using WordPress for your site platform? I’m new to the blog world but I’m

trying to get started and set up my own. Do you require any html

coding knowledge to make your own blog? Any help would be greatly appreciated!

Actually when someone doesn’t know afterward its up to other users that they will assist, so here it happens.

Definitely believe that which you stated. Your favorite reason seemed to

be on the net the simplest thing to be aware of. I say to you, I certainly get annoyed while people think about worries

that they plainly do not know about. You managed to hit the nail

upon the top and also defined out the whole thing without having

side effect , people can take a signal. Will likely

be back to get more. Thanks

Excellent weblog right here! Additionally your site

so much up very fast! What web host are you the use of? Can I get your affiliate hyperlink to your host?

I want my website loaded up as fast as yours lol

What’s up to every , for the reason that I am truly keen of reading this web site’s post to

be updated daily. It includes good information.

My partner and I stumbled over here from a different web page and thought I might check things out.

I like what I see so i am just following you.

Look forward to checking out your web page again.

Awesome issues here. I’m very happy to peer your post.

Thanks a lot and I’m taking a look forward to touch you.

Will you kindly drop me a e-mail?

Hi, i think that i saw you visited my site so i came to “return the

favor”.I’m trying to find things to improve my

website!I suppose its ok to use a few of your ideas!!

Thank you for the good writeup. It actually was a amusement

account it. Glance advanced to more delivered agreeable from you!

However, how can we communicate?

My brother suggested I might like this web site.

He was totally right. This post actually made my day.

You can not imagine simply how much time I had spent for this information!

Thanks!

I am curious to find out what blog system you are using?

I’m having some minor security issues with my latest site and I’d like to find something more secure.

Do you have any recommendations?

bookmarked!!, I really like your web site!

This blog was… how do I say it? Relevant!! Finally I

have found something that helped me. Thanks!

Ahaa, its pleasant dialogue on the topic of this piece of

writing at this place at this webpage, I have read all that, so now

me also commenting here.

Very descriptive post, I loved that a lot. Will there be a part 2?

I’m really enjoying the theme/design of your site.

Do you ever run into any browser compatibility issues?

A couple of my blog visitors have complained about my website

not operating correctly in Explorer but

looks great in Opera. Do you have any solutions to help fix this issue?

You could certainly see your enthusiasm within the article you

write. The sector hopes for more passionate writers such as you

who are not afraid to say how they believe. At all times go after your heart.

My family every time say that I am wasting my time here at web,

but I know I am getting know-how all the time by reading such

pleasant articles.

Thanks a lot for sharing this with all of us you actually understand what you are speaking about!

Bookmarked. Please additionally talk over with my

website =). We can have a hyperlink trade arrangement

among us

This post is truly a nice one it assists new web visitors,

who are wishing for blogging.

I do consider all of the concepts you’ve introduced for your post.

They are really convincing and will definitely work. Nonetheless, the posts are very quick for novices.

Could you please prolong them a bit from subsequent time?

Thank you for the post.

I was wondering if you ever considered changing the

layout of your blog? Its very well written; I love what youve got

to say. But maybe you could a little more in the way of content

so people could connect with it better. Youve got an awful lot of text for only having 1 or two images.

Maybe you could space it out better?

Hey there I am so glad I found your weblog, I really found

you by mistake, while I was searching on Yahoo for something else, Anyways I am here now and would just like

to say thanks for a tremendous post and a all round entertaining blog (I also love the theme/design), I don’t

have time to browse it all at the moment but I have book-marked it and also included your RSS feeds, so when I have

time I will be back to read a lot more, Please

do keep up the great b.